— Ranked by AuM and Investment Activity 2021

— Clustered by Stage and Industry Focus

The 2022 European Capital Report

Most Powerful Investment Funds in Europe

- 550 European VCs

- 272 European PEs

- 61 Newcomer Funds 2022

- 146 Non-European Investors with European Presence

The European Capital Map 2022

published by i5invest | i5growth and WU Entrepreneurship Center

As a record-breaking year in many ways, 2021 brought staggering tech valuations and created many new unicorns. In parallel, the number of newly founded investors in Europe slowed down significantly. With 61 new European funds established in the last 12 months, the total number of players is now at 817. This report sheds light on the investors shaping Europe’s venture capital and private equity ecosystem. In funding the most promising Startups, they play an essential role in our economic future and create an impact well beyond the continent’s borders.

Download the free report and get your hands on everything you need to know about Europe’s most powerful investment funds!

This is version 2.2 – edited in June 2022 | The data freeze for version 2.2 was June 2022

Most Powerful Investment Funds – DACH Region

Germany, Austria, Switzerland and Liechtenstein

TOP 10 VCs

based on AuM

1. Target Global

2. HV Capital

3. Earlybird Venture Capital

3. Global Founders Capital

3. Lakestar

6. DTCP

6. MIG Verwaltungs AG

6. Wellington Partners

9. High-Tech Gründerfonds

10. Redalpine Venture Partners

TOP 10 PEs

based on AuM

1. Partners Group

2. Schroder Adveq Management

3. Lindsay Goldberg Europe

4. Bregal Unternehmerkapital

5. Capvis

6. SwanCap

7. Deutsche Beteiligungs AG

8. Franz Haniel & Cie

9. DPE Deutsche Private Equity

10. Quadriga Capital

Most Powerful Investment Funds – UK & Ireland

TOP 10 VCs

based on AuM

1. Atomico

1. Balderton Capital

3. BGF

4. Octopus Investments

5. Octopus Ventures

6. Highland Europe

7. 83North

8. Northzone

9. Scottish Equity Partners

10. Anthemis Group

TOP 10 PEs

based on AuM

1. Intermediate Capital Group

2. Permira

3. Apax Partners

4. HG Capital

5. Bridgepoint

6. BC Partners

7. Cinven

8. 3i Group

9. Triton

10. Capital Dynamics

Most Powerful Investment Funds – Northern Europe

Sweden, Denmark, Finland, Norway, Estonia and Iceland

TOP 10 VCs

based on AuM

1. Novo Holdings

2. Verdane

3. EQT Ventures

4. Investinor

5. Industrifonden

6. Heartcore Capital

7. Gullspang Re:food

8. Inventure

9. Nordic Eye Venture Capital

10. Equinor Ventures

TOP 10 PEs

based on AuM

1. Nordic Capital

2. Kinnevik

3. Altor Equity Partners

4. HitecVision

5. CapMan

6. FSN Capital

7. Summa Equity

8. Cubera

9. Norvestor

10. Polaris Private Equity

Most Powerful Investment Funds – BENELUX Region

Belgium, The Netherlands, Luxembourg

TOP 10 VCs

based on AuM

1. Forbion

2. Mangrove Capital Partners

3. Prime Ventures

4. Rabo Corporate Investments

5. M Ventures

6. Endeit Capital

7. Inkef Capital

8. Hummingbird Ventures

9. ING Ventures

10. Innovation Industries

TOP 10 PEs

based on AuM

1. CVC Capital Partners

2. Sofina

3. Waterland Private Equity

4. Cobepa

5. Main Capital Partners

6. Egeria

6. Ergon Capital Partners

6. Gimv

9. Gilde Healthcare Partners

10. Life Sciences Partners

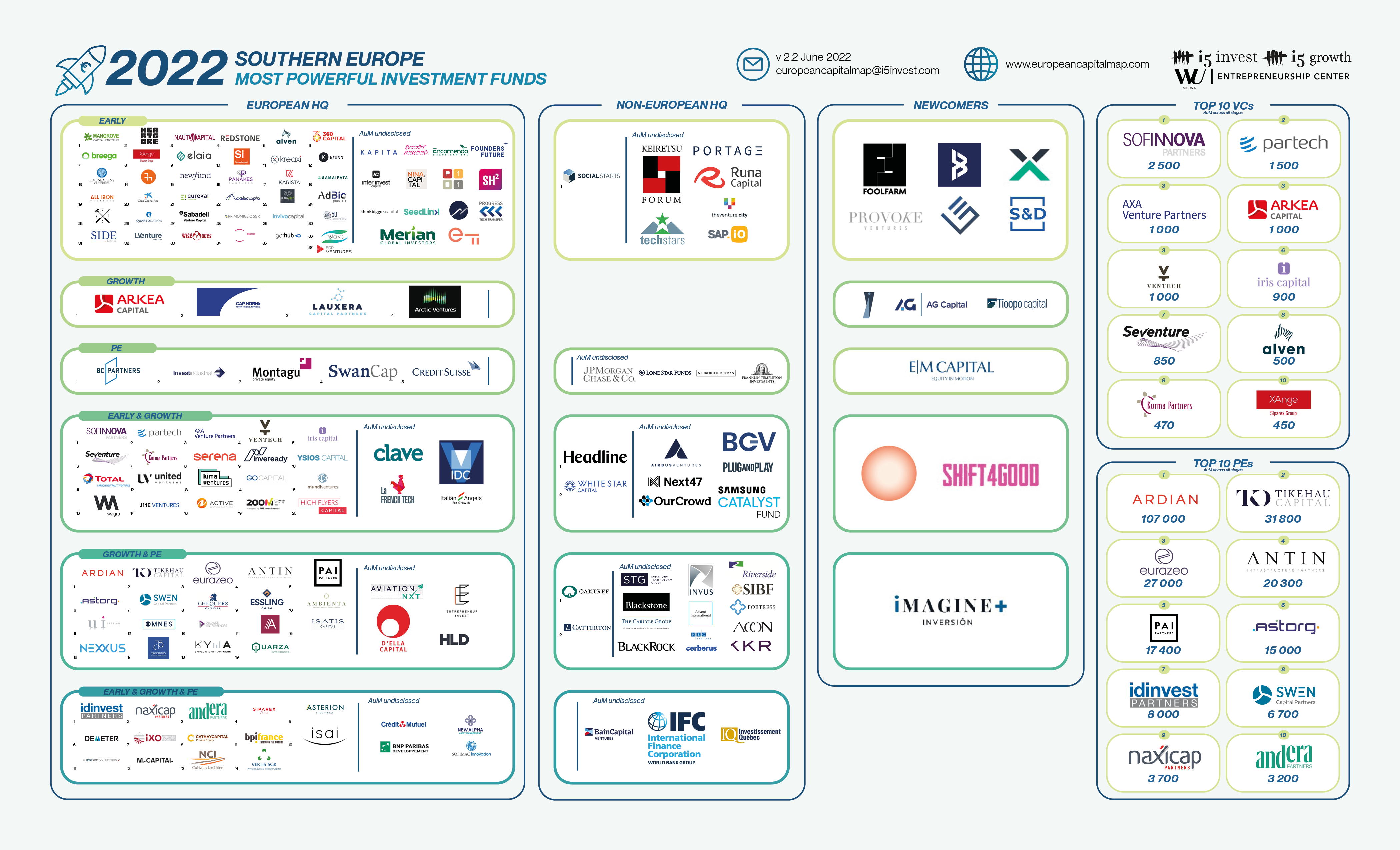

Most Powerful Investment Funds – Southern Europe

France, Spain, Italy, Portugal, Monaco and Cyprus

TOP 10 VCs

based on AuM

1. Sofinnova Partners

2. Partech

3. Arkea Capital

3. AXA Venture Partners

3. Ventech

6. Iris Capital

7. Seventure Partners

8. Alven Capital Partners

9. Kurma Partners

10. XAnge

TOP 10 PEs

based on AuM

1. Ardian

2. Tikehau Capital

3. Eurazeo

4. Antin Infrastructure Partners

5. PAI Partners

6. Astorg

7. Idinvest Partners

8. SWEN Capital Partners

9. Naxicap Partners

10. Andera Partners

Most Powerful Investment Funds – Eastern Europe

Ukraine, Poland, Czech Republic, Lithuania, Slovakia, Hungary, Croatia, Malta, Romania, Bulgaria and Latvia

TOP 10 VCs

based on AuM

1. Hiventures

2. PortfoLion Capital Partners

3. Credo Ventures

4. Impulse Ventures

4. KAYA VC

6. Practica Capital

7. Aria

8. Fil Rouge Capital

9. Neulogy Ventures

10. Early Game Ventures

TOP 10 PEs

based on AuM

1. Enterprise Investors

2. Innova Capital

3. MCI

4. EnerCap

5. ARX

5. Jet Investment

7. Axxess Capital

8. GB & Partners

9. Euroventures

10. Quaestus

Newcomers 2022

DOWNLOAD THE FULL 2022 REPORT FOR FREE

The full report includes detailed information on all featured VCs & PEs as well as portraits on the newcomer funds 2021, and includes a search index clustered by stage and investment focus.

Previous Publications

About the Publishers

As an international tech M&A, corporate finance advisory, investor and venture builder, the primary focus of i5invest/i5growth is to support growth and manage corporate development and cross-border M&A processes for extraordinary tech companies. Operating out of Berlin, Palo Alto, San Francisco and Vienna, i5 has set up over 150 strategic partnerships and international M&A transactions with companies such as Google, Microsoft, Salesforce, Verizon, Verisign, Samsung, Cisco, Telefonica, NBC, Naspers, Volkswagen, Amdocs, IAC, Pfizer/Zoetis, Nvidia, Airbus, Toronto Stock Exchange and many other global tier 1 technology giants.

Since its foundation in 2015, the goal of the WU Entrepreneurship Center is to show how starting a business can open up attractive perspectives for careers and personal development. The WU Entrepreneurship Center promotes, develops, and celebrates entrepreneurship, i.e. the entrepreneurial mindset and innovation as key skills for the 21st century. In this way, the WU Entrepreneurship Center acts as an ecosystem developer and think tank that helps to develop the full potential of university-affiliated start-ups.

Selected i5invest Transactions & Exits

WANT TO JOIN THE i5-TEAM?

We are convinced that the companies we work with will change the world!

Jobs at i5invest, i5growth and selected portfolio companies